1 2 march 2018 |

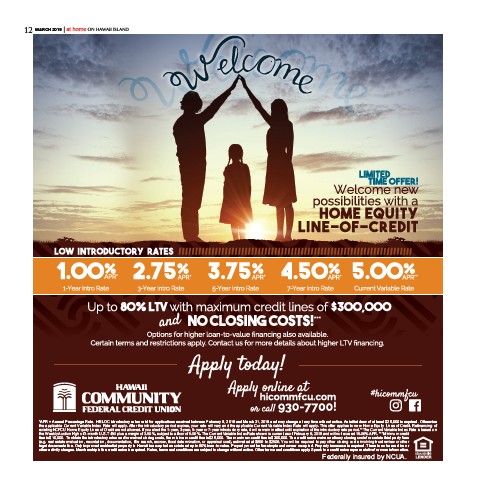

*APR = Annual Percentage Rate. HELOC introductory rates valid for applications received between February 9, 2018 and March 31, 2018 and may change at any time without notice. An initial draw of at least $25,000 is required. Otherwise

WKHDSSOLFDEOH&XUUHQW9DULDEOH,QGH5DWHZLOODSSO\$IWHUWKHLQWURGXFWRU\SHULRGHSLUHV\RXUUDWHZLOOYDU\DQGWKHDSSOLFDEOH&XUUHQW9DULDEOH,QGH5DWHZLOODSSO\7KLVRႇHUDSSOLHVWRQHZ+RPH(TXLW\/LQHVRI&UHGLW5H¿QDQFLQJRI

HLVWLQJ+&)&8+RPH(TXLW\/LQHVRI&UHGLWDUHQRWDOORZHG,I\RXHOHFWWKH\HDU\HDU\HDURU\HDULQWURGXFWRU\UDWHLWZLOOUHPDLQLQHႇHFWXQWLOHSLUDWLRQRIWKHLQWURGXFWRU\UDWHSHULRG7KH&XUUHQW9DULDEOH,QGH5DWHLVEDVHGRQ

WKH:HHNO\$XFWLRQ+LJKRIPRQWK867%LOOSOXVDPDUJLQRIVXEMHFWWRDÀRRURI7KH&XUUHQW9DULDEOH,QGH5DWHVKRZQLVFXUUHQWDVRI)HEUXDU\DQGZLOOQRWHFHHG$350LQLPXPFUHGLW

line is $10,000. To obtain the introductory rates and/or waived closing costs, the minimum credit line is $25,000. The maximum credit line is $300,000. The credit union waives ordinary closing costs for certain third party fees

HJUHDOHVWDWHHYDOXDWLRQUHFRUGDWLRQGRFXPHQWDWLRQWLWOHVHDUFKHVFURZÀRRGGHWHUPLQDWLRQRUDSSUDLVDOFRVWHVWLPDWHGDWWR<RXZLOOEHUHTXLUHGWRSD\RWKHUFORVLQJFRVWVLQYROYLQJWUXVWUHYLHZRURWKHU

legal documentation. Only improved residential property in Hawaii is accepted as collateral up to 80% loan-to-value. Property must be fee-simple and owner occupied. Property insurance is required. There is no transaction or

other activity charges. Membership in the credit union is required. Rates, terms and conditions are subject to change without notice. Other terms and conditions apply. Speak to a credit union representative for more information.

Federally insured by NCUA.